Glossary for retailers

Before you begin the reporting process, get up to date on key concepts by consulting the glossary for retailers.

First supplier

Domiciled or established in Québec, a first supplier is the first to take title, possession or control of a designated printed matter, a product marketed with a designated container or packaging or a short-life container or packaging sold as a product in Québec.

For example, a retailer that imports or distribute a product whose owner is located in Ontario and does not have a place of business in Québec must report the containers, packaging and printed matter it imports or distribute.

Containers and packaging added at the point of sale

Containers and packaging added at the point of sale include all the containers and packaging provided to a consumer to protect or transport a product (e.g. plastic bag). These containers and packaging are provided to the consumer by the point of sale.

Retail outlet

For the purpose of applying the Schedules of Contributions, a retail outlet is the premises or location at which a retailer conducts business activities consisting mainly of retail sales.

These sales are generally made to the public, including certain corporations when their purchases are not made to complete a production or resale process.

If you operate only one retail outlet, you may be exempted from paying a contribution. This outlet must be smaller than 929 m2. Note that a company whose products or services are only sold online are not exempted from payment.

Consult the exemption criteria for further details.

CP&PM sold as products

“CP&PM” are containers, packaging and printed matter. “CP&PM sold as products” refer to all short-life containers and packaging and printed matter ultimately purchased as products by consumers and whose physical and esthetic features are altered following the first uses. In sum, “CP&PM sold as products” are any flexible or rigid material used to contain, protect or wrap a product or paper and other cellulosic fibres, whether or not used as a medium for text or images available for purchase by consumers through a retailer or distributor

For example, aluminum plates that are sold as products to consumers who use them to bake homemade pies. Because they are sold to consumers as containers and also because their physical and esthetic features are altered by use, aluminum pie plates constitute CP&PM sold as products and must be included in the company reports.

Primary packaging

Primary packaging is the packaging that contains the product being sold. It is therefore in direct contact with the product. For example, the tube that contains toothpaste is primary packaging. Primary packaging must be reported.

Secondary packaging

Secondary packaging is the second level of packaging. In a single product unit, it is especially used to provide consumer information. For example, the box that contains the tube of toothpaste is secondary packaging. Secondary packaging also refers to packaging used to group several products into a single unit for purchase. For example, the plastic film used to wrap boxed tubes of toothpaste sold in a three-pack is considered secondary packaging. Secondary packaging sold to consumers must be reported.

Deduction for packaging taken back after delivery

When companies that deliver merchandise take back the packaging used to protect the delivered goods, they may deduct this packaging from the quantities of materials they report. More information on the methodology used to calculate this deduction is available in the Methodology tab in the reporting portal.

Deduction for CP&PM ultimately intended for industrial, commercial and institutional establishments

The containers, packaging and printed matter intended for a final consumer that is an industrial, commercial or institutional establishment are excluded from the calculation to determine the total contribution and therefore do not need to be reported.

Deduction for long-life packaging (five years)

Long-life containers and packaging (i.e. those meant to contain, protect or store products during their service lives) are excluded when they are designed for a service life of at least five years. For example, the box in which a puzzle or board game is sold in or the box in which certain tools are sold in constitute long-life packaging. Note: If the box is wrapped in plastic, this packaging must be reported.

Deduction for containers and packaging subject to another type of extended producer responsibility (EPR) program

If your containers, packaging or printed matter are subject to a deposit system recognized under Québec law or any other recovery and reclamation program based on the principle of extended producer responsibility, they are excluded from the calculation to determine the total contribution. Note that all the containers and packaging included with these products must be reported (e.g. the cardboard packaging for returnable bottles).

For more information on extended producer responsibility, go to RECYC-QUÉBEC dedicated (in French) or read more on the in Québec (in French).

Name

A name is the designation under which a company operates as a corporation, a partnership or an individual.

Brand

Generally speaking, a brand is used by a company to set its products and services apart from others (e.g. a trademark). This definition does not include certification marks.

Distinguishing guise

A distinguishing guise is the unique way an organization wraps or packages a product to set itself apart or distinguish a product from others on the market.

Methodology to facilitate the reporting process

It is important to explain the methodology used to collect or estimate your data as part of the reporting process. In this section, you will find everything you need to develop your own work methodology.

Use the dedicated page in the reporting portal to detail your methodology.

Methodological steps

- List all the products sold during the reporting year

- Determine those responsible for each product: – Include all the containers, packaging and printed matter related to your private brand products and those for which you are the first supplier in Québec.

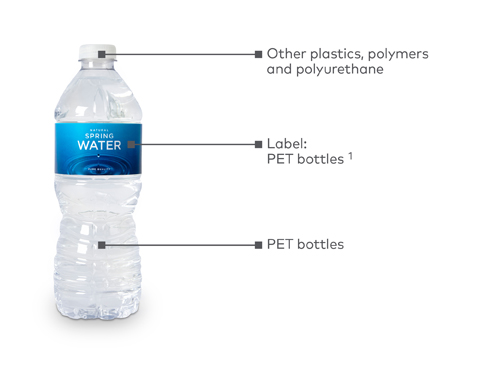

- Identify the components of each product for which you are responsible. For example, for a bottle of water sold individually, you must report:

– weight of the bottle including the label

– cap - Note that the containers, packaging and printed matter sold as products (product CP&PM) are designated materials and must be reported by your company, if applicable.

- For example: – aluminium pie plates; – snack, sandwich and freezer bags; – paper and polystyrene plates and glasses.

- Include all secondary and tertiary packaging that will ultimately end up with the consumer. For example:

– the plastic film and cardboard tray used to wrap bottles of water sold by the carton. - Include the materials added at the point of sale.

- – receipts and invoices

– shopping and prescription bags

– meat trays

– gift wrapping, etc. - Include all marketing-related printed matter.

- – flyers

– catalogues

– inserts

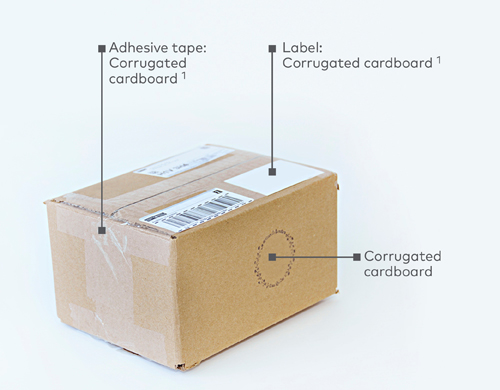

– promotional booklets, etc. - List all the containers, packaging and printed matter used to fulfill online orders.

For example:

– shipping boxes

– padded envelopes, etc. - List the products distributed free of charge at special and promotional events.

- Indicate the data sources used to complete your report. For example: real unit weight determined manually or provided by the manufacturer, supplier or printer.

Allowable deductions

- The transport packaging that is not ultimately meant for consumers.

- Containers, packaging and printed matter recovered after in-home delivery.

- Returned merchandise that is:

– recalled

– expired

– damaged and cannot be sold to a consumer

– not distributed.

- All containers, packaging and printed matter used or recovered in-house, unsold or not distributed.

- All refundable containers. For example: soft drink containers, etc. Note, however, that any containers or packaging accompanying these products must be declared (for example, the cardboard box containing the returnable bottles).

- Containers and packaging meant for a final consumer that is an industrial, commercial or institutional establishment.

Information to have on hand when filling a report online

- Describe your activities and products and list the number of points of sale or entities in Québec.

- Mention the changes since the last report.

Explain any considerable variations between the current quantities you are reporting and those included in the last report.

For example:

– Increase or decrease in sales (%)

– launch of new products

– store openings or closures

– acquisition or sale of brands

– reduction in packaging

– implementation of new measures

Reporting the containers, packaging and printed matter you put on the market in Québec each year can be a time-consuming exercise. But the right tools make it easier!

Examples of designated materials to include in your report

| Food products / electronics / apparel and sporting goods / hardware / others | |

|---|---|

| Products: | To be classified in: |

|

Flyers / inserts |

Flyers and inserts printed on newspaper / Other printed matter (if printed on another type of paper) |

|

Gift card packaging |

Boxboard and other paper packaging |

|

Shopping bags |

HDPE, LDPE shopping bags and others |

|

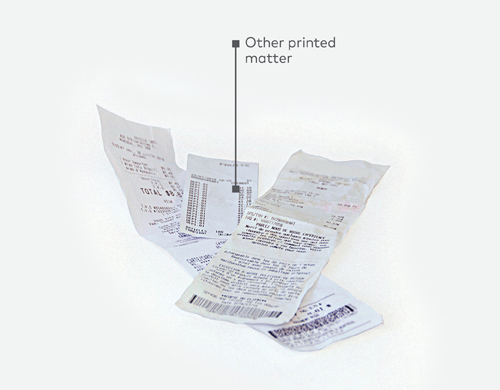

Sales slips |

Other printed matter |

|

Boxes and packaging for online orders |

Corrugated cardboard and other printed matter |

|

Packaging added at the point of sale |

PET containers / Expanded polystyrene – food packaging / Non-expanded polystyrene / Kraft wrapping paper |

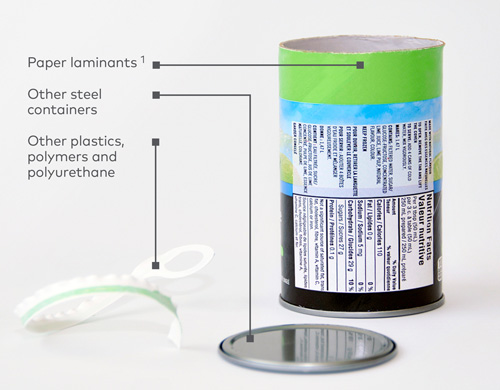

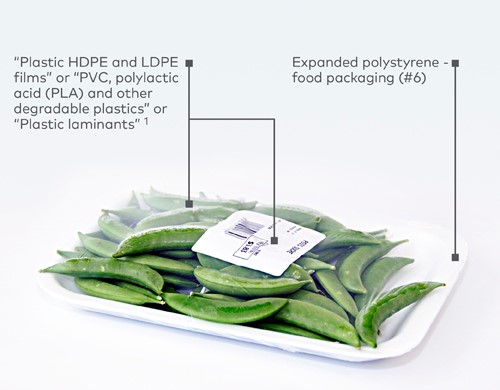

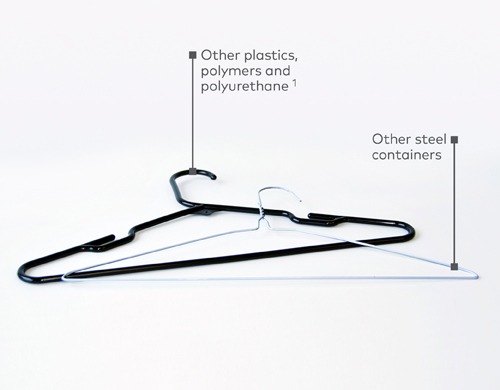

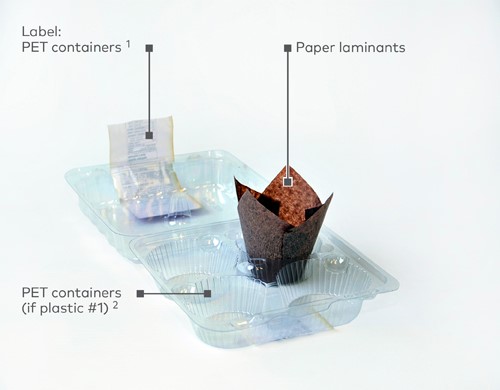

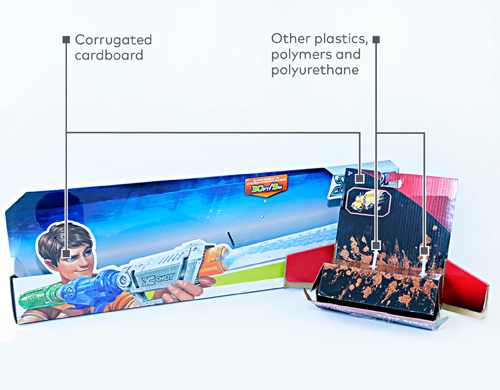

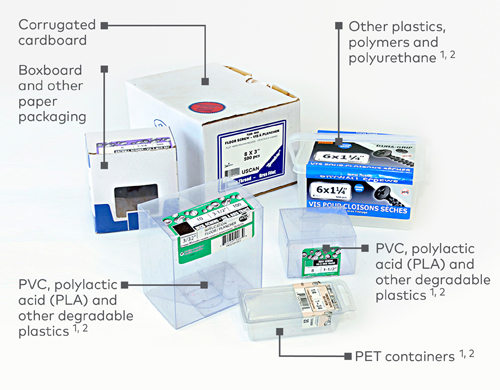

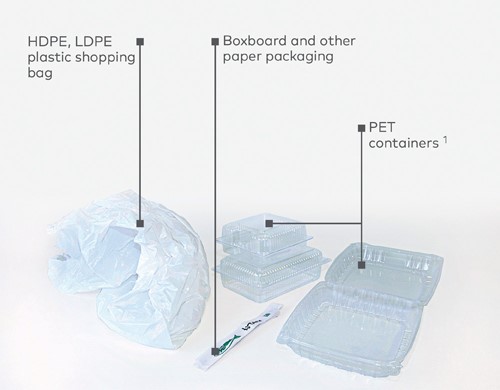

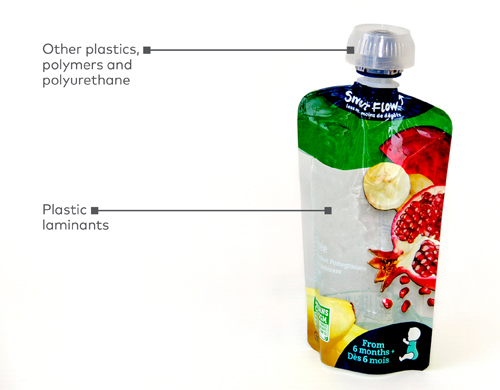

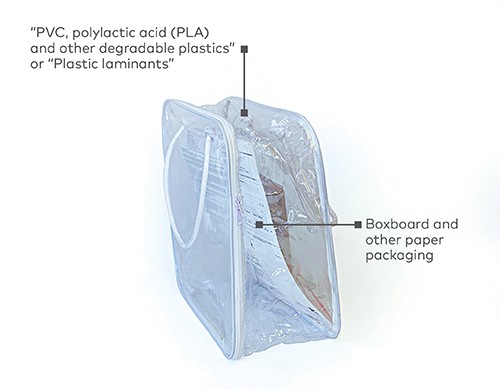

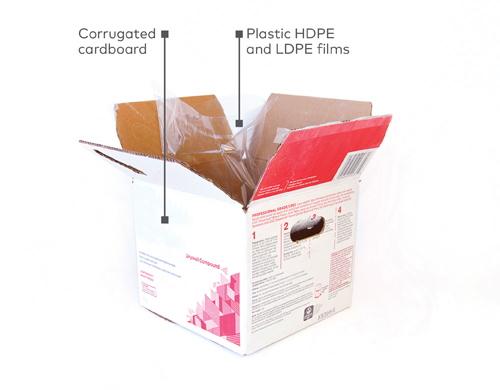

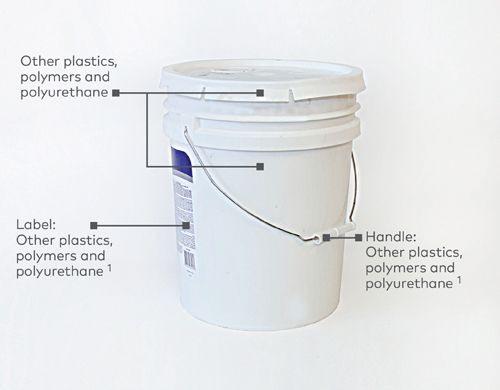

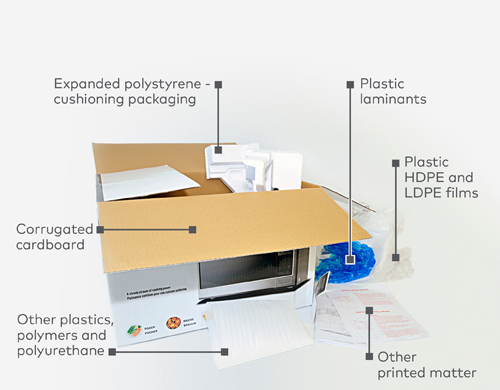

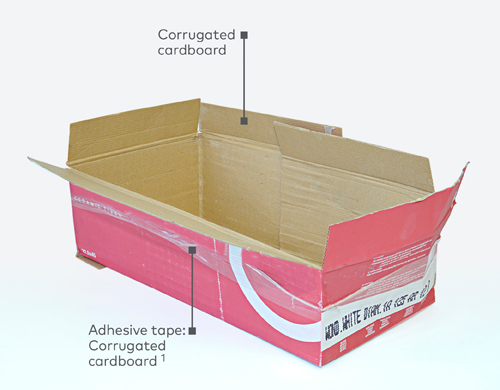

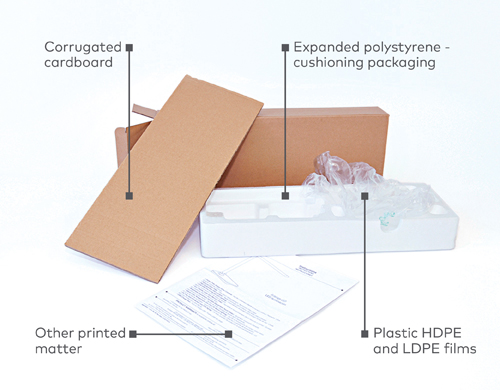

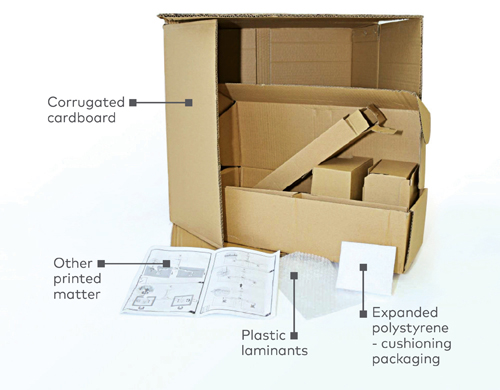

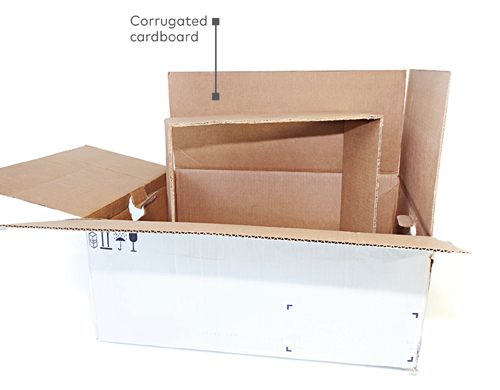

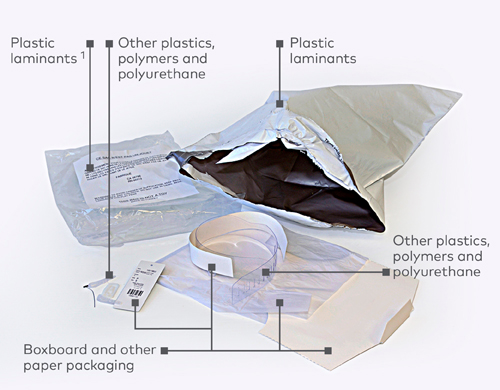

Examples of containers, packaging and printed matter made up of several materials subject to a fee

Some containers, packaging and printed matter raise a few questions. In what material class should I report the bottlecap, label or lid? A picture is worth a thousand words!

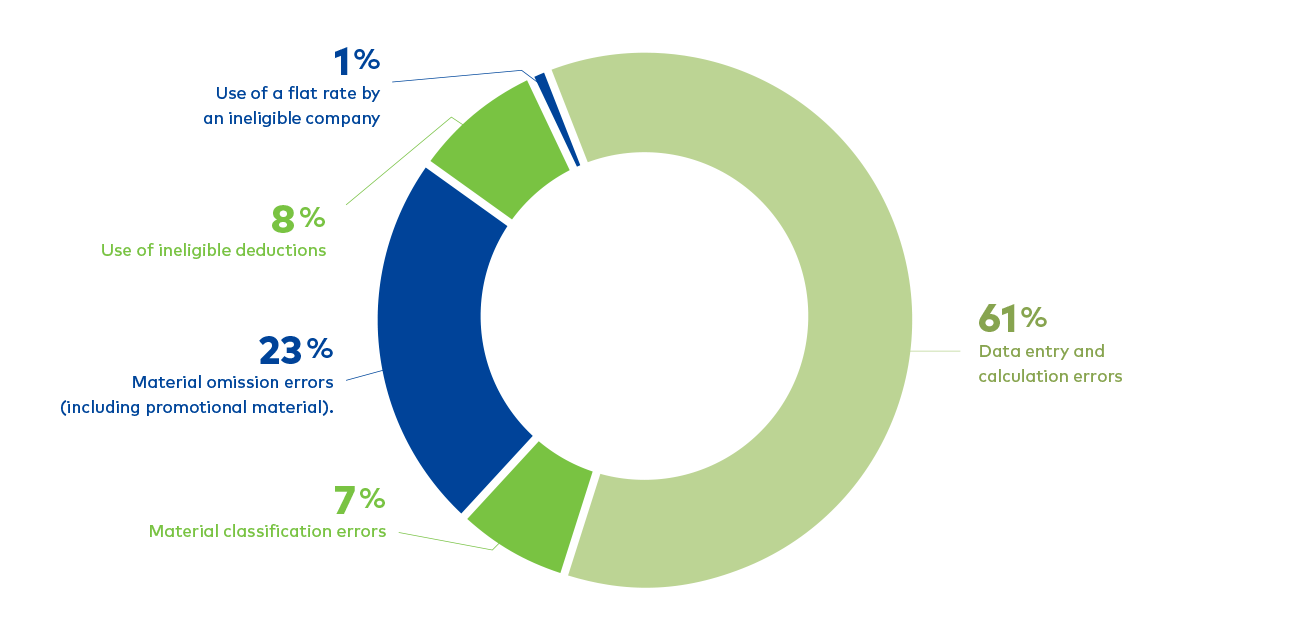

Common errors by retailers

The reports filed by retailers often contain the same errors. Here are some tips and tricks to help you avoid them!

Making keying and calculation errors

| Examples and explanations | Tips |

Entry of incorrect or inexact data or data with the decimal in the wrong position |

For example, if a company sells a pack of 24 bottles of water in a cardboard box ultimately intended for the consumers, it must report the box and 24 times the weight of the plastic bottle. The error is much more common when entering data for boxes of multipacks. For example, when a box contains four packs of six bottles wrapped in plastic, 1 cardboard box (if intended for the consumers), 4 overpack films and 24 bottles must be reported. |

Subtracting ineligible deductions

| Examples and explanations | Tips |

|

|

Not reporting the designated materials for imported products for which you are the first supplier.

| Examples and explanations | Tips |

|

|

Not compiling the materials added at the point of sale

| Examples and explanations | Tips |

|

|

Not reporting materials from multipack containers and packaging or reporting materials in the wrong category

| Examples and explanations | Tips |

|

|

Not reporting advertising material

| Examples and explanations | Tips |

|

|

Not reporting the sales packaging generated through e-commerce

| Examples and explanations | Tips |

|

|

Not reporting the materials included with products covered by other regulations (e.g. box for deposit cans)

| Examples and explanations | Tips |

When you sell a container subject to another regulation, you must include all secondary packaging (if applicable), since it is generally not targeted by other regulations. |

|

Not subtracting supplies used in house or discarded (e.g. trays with expired meat)

| Examples and explanations | Tips |

As part of their operations, retailers may experience losses of products packaged on site—particularly meats, fruits and vegetables and bakery products—when expiry dates pass. These products, which cannot be sold, are discarded with their packaging, which should be excluded from the quantities reported. In addition, retailers sometimes use packaging supplies within their stores (e.g. a retailer that uses plastic film to protect certain merchandise at the end of the day). These supplies, which are not provided to consumers, should also be excluded from the quantities reported. |

|