Glossary for distributors

Before you begin the reporting process, get up to date on key concepts by consulting the glossary for distributors.

Brand

Generally speaking, a brand is used by a company to set its products and services apart from others (e.g. a trademark). This definition does not include certification marks.

CP&PM sold as products

“CP&PM” are containers, packaging and printed matter. “CP&PM sold as products” refer to all short-life containers and packaging and printed matter ultimately purchased as products by consumers and whose physical and esthetic features are altered following the first uses. In sum, “CP&PM sold as products” are any flexible or rigid material used to contain, protect or wrap a product or paper and other cellulosic fibres, whether or not used as a medium for text or images available for purchase by consumers through a retailer or distributor

For example, aluminum plates that are sold as products to consumers who use them to bake homemade pies. Because they are sold to consumers as containers and also because their physical and esthetic features are altered by use, aluminum pie plates constitute CP&PM sold as products and must be included in the company reports.

Deduction for containers and packaging subject to another type of extended producer responsibility (EPR) program

If your containers, packaging or printed matter are subject to a deposit system recognized under Québec law or any other recovery and reclamation program based on the principle of extended producer responsibility, they are excluded from the calculation to determine the total contribution. Note that all the containers and packaging included with these products must be reported (e.g. the cardboard packaging for returnable bottles).

For more information on extended producer responsibility, go to RECYC-QUÉBEC dedicated (in French) or read more on the in Québec (in French).

Deduction for long-life packaging (five years)

Long-life containers and packaging (i.e. those meant to contain, protect or store products during their service lives) are excluded when they are designed for a service life of at least five years. For example, the box in which a puzzle or board game is sold in or the box in which certain tools are sold in constitute long-life packaging. Note: If the box is wrapped in plastic, this packaging must be reported.

Deduction for CP&PM ultimately intended for industrial, commercial and institutional establishments

The containers, packaging and printed matter intended for a final consumer that is an industrial, commercial or institutional establishment are excluded from the calculation to determine the total contribution and therefore do not need to be reported.

Deduction for packaging taken back after delivery

When companies that deliver merchandise take back the packaging used to protect the delivered goods, they may deduct this packaging from the quantities of materials they report. More information on the methodology used to calculate this deduction is available in the Methodology tab in the reporting portal.

Deduction for transport packaging

The containers and packaging designed to facilitate the shipping and handling of a certain number of sales units or grouped packaging and which are not ultimately intended for consumers are excluded from the calculation to determine the total contribution and therefore do not need to be reported.

Distinguishing guise

A distinguishing guise is the unique way an organization wraps or packages a product to set itself apart or distinguish a product from others on the market.

First supplier

Domiciled or established in Québec, a first supplier is the first to take title, possession or control of a designated printed matter, a product marketed with a designated container or packaging or a short-life container or packaging sold as a product in Québec.

For example, a retailer that imports or distribute a product whose owner is located in Ontario and does not have a place of business in Québec must report the containers, packaging and printed matter it imports or distribute.

Indirect sales

Indirect sales are all products shipped to a distribution centre located outside Québec (e.g. Ontario) that are then reshipped to Québec to be sold by retailers in stores located in Québec.

Name

A name is the designation under which a company operates as a corporation, a partnership or an individual.

Primary packaging

Primary packaging is the packaging that contains the product being sold. It is therefore in direct contact with the product. For example, the tube that contains toothpaste is primary packaging. Primary packaging must be reported.

Secondary packaging

Secondary packaging is the second level of packaging. In a single product unit, it is especially used to provide consumer information. For example, the box that contains the tube of toothpaste is secondary packaging. Secondary packaging also refers to packaging used to group several products into a single unit for purchase. For example, the plastic film used to wrap boxed tubes of toothpaste sold in a three-pack is considered secondary packaging. Secondary packaging sold to consumers must be reported.

Tertiary packaging

Tertiary packaging is used to ship and handle products. For example, the cardboard boxes, separators and shrink wrap used to stock products on a pallet are tertiary packaging.

Methodology to facilitate the reporting process

It is important to explain the methodology used to collect or estimate your data as part of the reporting process. In this section, you will find everything you need to develop your own work methodology.

Use the dedicated page in the reporting portal to detail your methodology.

Steps

- List all the products sold during the reporting year.

- Determine those responsible for each product:

– Include all the containers, packaging and printed matter related to your private brand products and those for which you are the first supplier in Québec.

– To help you identify products sold under a supplier’s brand for which you are not responsible, consult the list of companies that must file a report in the reporting system.

- Identify the components of each product for which you are responsible.

For example, for a box of resealable freezer bags:

– Weight of the box

– The resealable bags themselves will be designated as a product CP&PM (see the following point).

- Note that the containers, packaging and printed matter sold as products (product CP&PM) are designated materials and must be reported by your company, if applicable.

For example:

– Aluminium pie plates

– Snack, sandwich and freezer bags

– Paper and polystyrene plates and glasses

– Snack, sandwich and freezer bags.

- Include all secondary and tertiary packaging that will ultimately end up with the consumer. For example: the plastic film and cardboard tray used to wrap bottles of water sold by the carton.

- Indicate the data sources used to complete your report.

For example: real unit weight determined manually or provided by the manufacturer, supplier or printer.

Deductions

- The transport packaging that is not ultimately meant for consumers.

- Returned merchandise that is :

– recalled

– expired

– damaged and cannot be sold to a consumer

– not distributed.

- All containers, packaging and printed matter used or recovered in-house, unsold or not distributed due to recall.

- All refundable containers. For example: soft drink containers, etc. Note, however, that any containers or packaging accompanying these products must be declared (for example, the cardboard box containing the returnable bottles).

- Containers and packaging meant for a final consumer that is an industrial, commercial or institutional establishment.

Declaration

- Describe your activities and products and list the number of points of sale or entities in Québec.

- Mention the changes since the last report.

Explain any considerable variations between the current quantities you are reporting and those included in the last report.

For example:

– increase or decrease in sales (%)

– launch of new products

– reduction in packaging

– implementation of new measures

Reporting the containers, packaging and printed matter you put on the market in Québec each year can be a time-consuming exercise. But the right tools make it easier!

Examples of designated materials to include in your report

| Food products | |

|---|---|

| Products: | To be classified in: |

|

Containers, films, netting bags for citrus |

Corrugated cardboard or PET containers or Plastic HDPE and LDPE films / Other plastics and polymers and polyurethane |

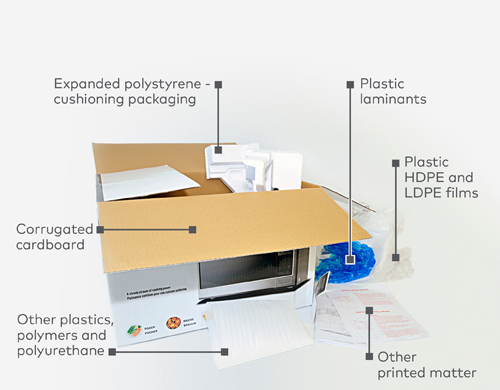

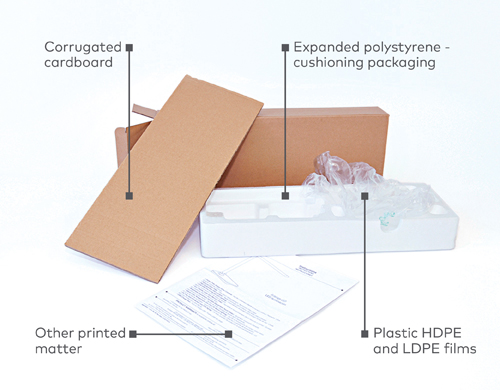

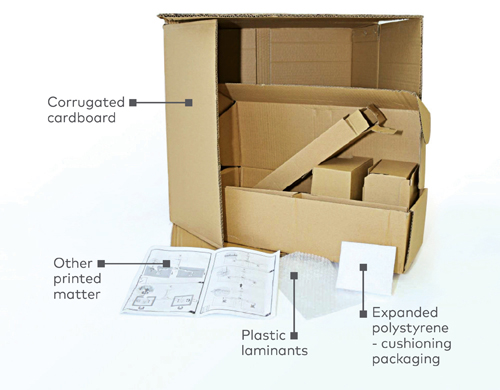

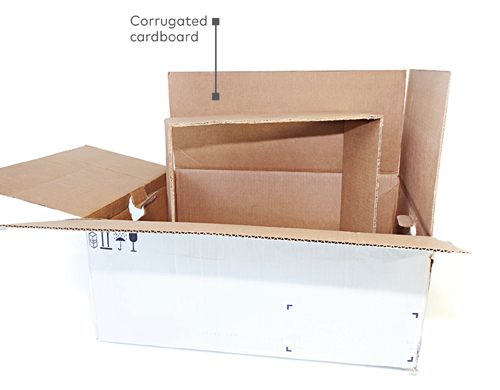

| Electronics | |

|---|---|

| Products: | To be classified in: |

|

Boxes |

Corrugated cardboard or Boxboard and other paper packaging |

|

Instruction manual and warranty information |

Other printed matter |

|

Miscellaneous containers and packaging |

Expanded polystyrene – cushioning packaging or Plastic HDPE and LDPE films or Plastics laminants or Other plastics, polymers and polyurethane |

| Sporting apparel and goods | |

|---|---|

| Products: | To be classified in: |

|

Boxes / tags / bags |

Corrugated cardboard or Other plastics, polymers and polyurethane |

| Hardware | |

|---|---|

| Products: | To be classified in: |

|

Miscellaneous containers and packaging |

Corrugated cardboard or PVC, polylactic acid (PLA) and other degradable plastics or PET containers or Plastic HDPE and LDPE films |

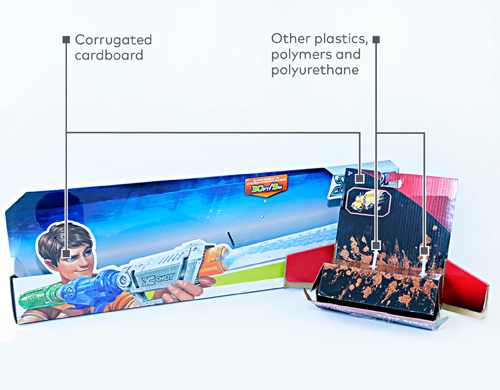

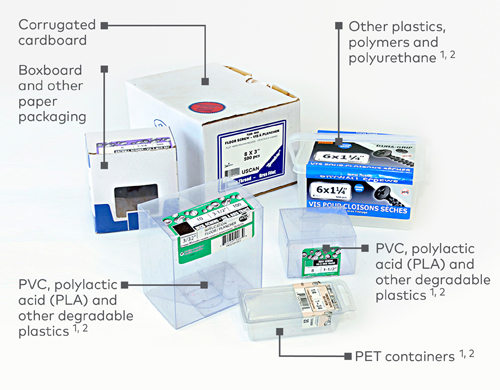

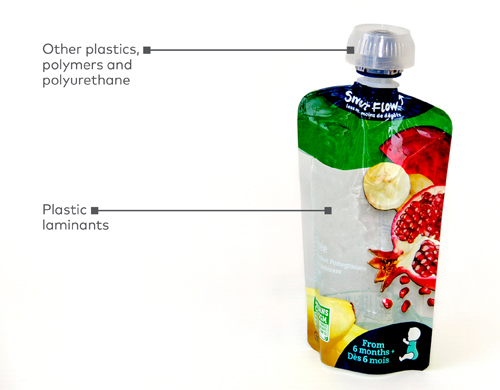

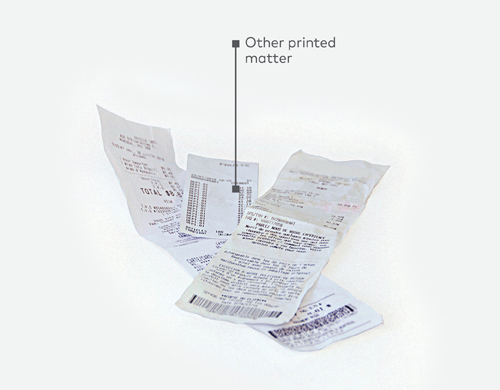

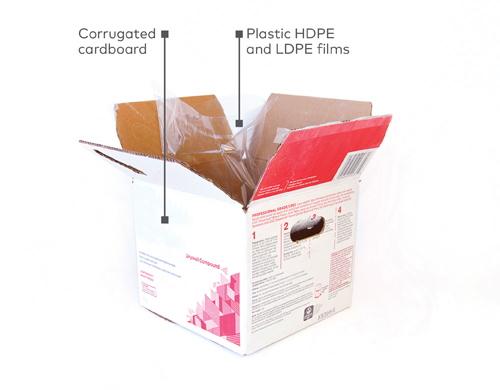

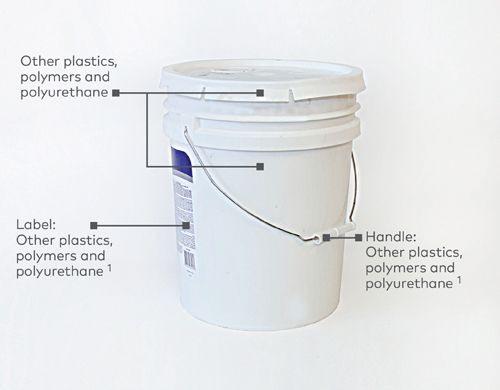

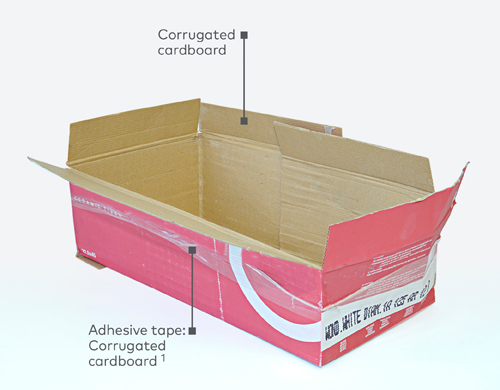

Examples of containers, packaging and printed matter made up of several materials subject to a fee

Some containers, packaging and printed matter raise a few questions. In what material class should I report the bottlecap, label or lid? A picture is worth a thousand words!

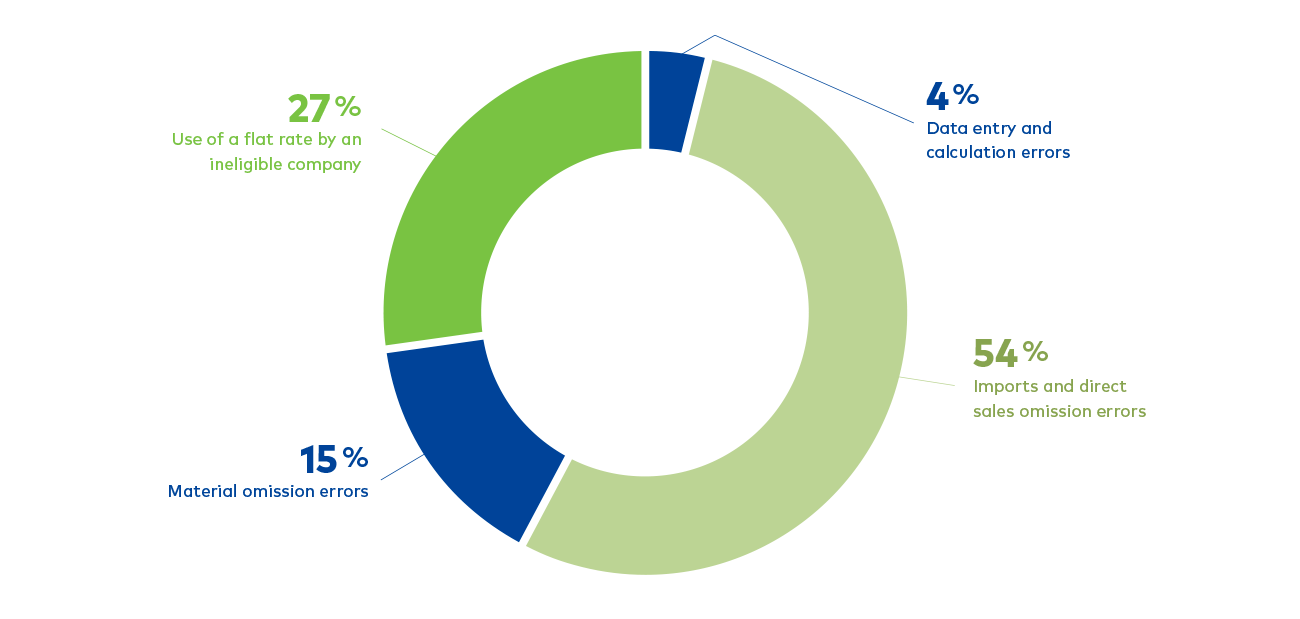

Common errors by distributors

Some containers, packaging and printed matter raise a few questions. In what material class should I report the bottlecap, label or lid? A picture is worth a thousand words!

Making keying and calculation errors

| Examples and explanations | Tips |

Entry of incorrect or inexact data or data with the decimal in the wrong position |

For example, if a company sells a pack of 24 bottles of water in a cardboard box ultimately intended for the consumers, it must report the box and 24 times the weight of the plastic bottle. The error is much more common when entering data for boxes of multipacks. For example, when a box contains four packs of six bottles wrapped in plastic, 1 cardboard box (if intended for the consumers), 4 overpack films and 24 bottles must be reported. |

Subtracting ineligible deductions

| Examples and explanations | Tips |

|

|

Not reporting the designated materials for imported products for which you are the first supplier.

| Examples and explanations | Tips |

|

|

Not reporting materials from multipack containers and packaging or reporting materials in the wrong category

| Examples and explanations | Tips |

|

|

Not reporting advertising material

| Examples and explanations | Tips |

|

|

Not reporting the sales packaging generated through e-commerce

| Examples and explanations | Tips |

|

|

Not reporting the materials included with products covered by other regulations (e.g. box for deposit cans)

| Examples and explanations | Tips |

When you sell a container subject to another regulation, you must include all secondary packaging (if applicable), since it is generally not targeted by other regulations. |

|